Included in the US Department of Justice’s updated guidance is a new policy on incentivizing companies to adopt compensation and bonus plans tied to compliance and ethical behavior.

LOCATION: US

EFFECTIVE: March 5, 2023

30-second take | 3-minute deeper dive | 3-second links

30-second take

- The US Department of Justice has announced a new policy and made several updates to their ongoing guidance on Evaluation of Corporate Compliance Programs (ECCP) on incentivizing companies to adopt compensation and bonus plans tied to compliance and ethical behavior.

- The DOJ’s new three-year initiative, the pilot program regarding compensation incentives and clawbacks, is the outgrowth of their September 2022 policy making personal responsibility for misconduct the department’s number one priority.

- Updates to the ECCP note that a “hallmark of effective implementation of a compliance program is the establishment of incentives for compliance and disincentives for non-compliance.”

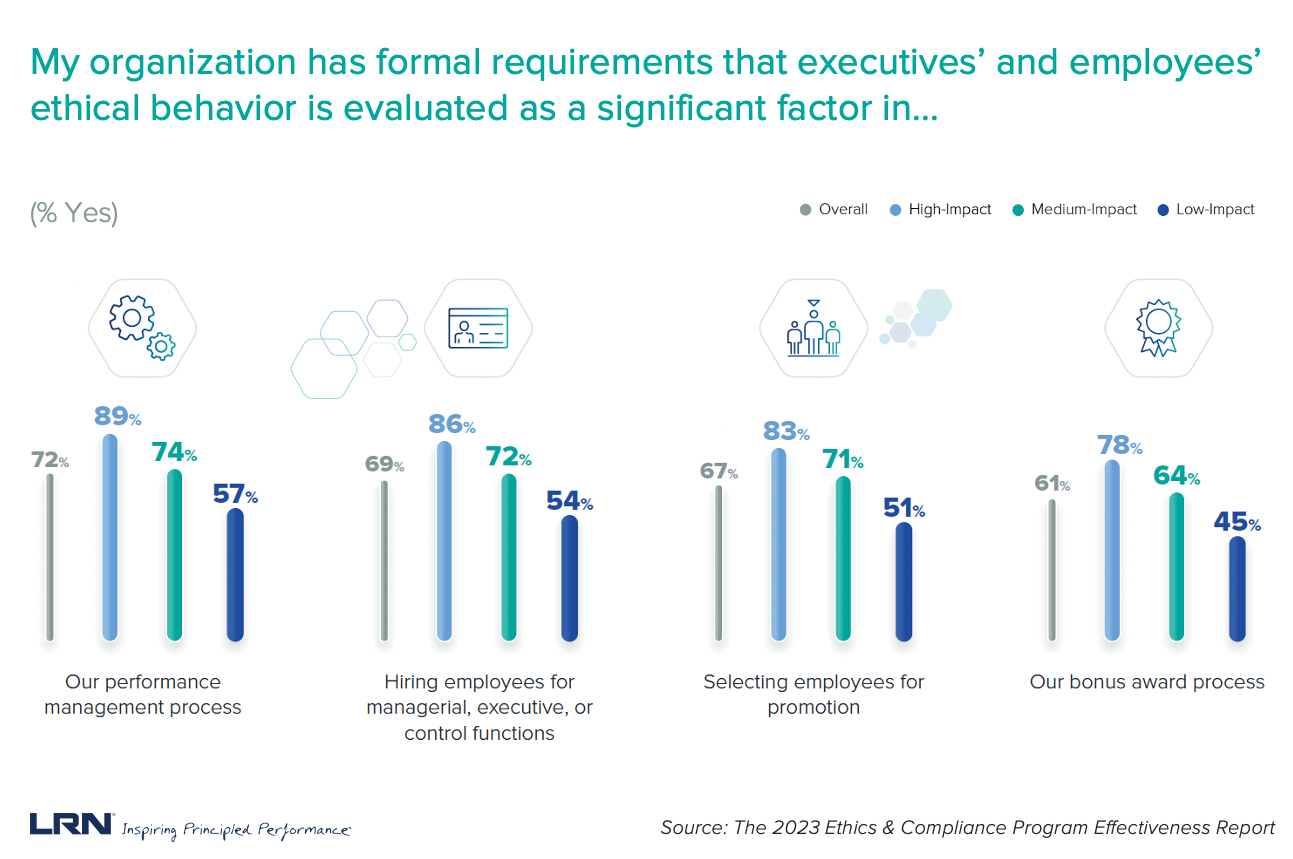

- As incentives and clawbacks tied to ethical conduct grow in regulatory importance, LRN research indicates that using ethical behavior as a significant factor in compensation, bonuses, hiring, and promotion is a best practice and hallmark of a highly effective ethics and compliance program.

3-minute deeper dive

On March 3, 2023, the Department of Justice unveiled several updates to their ongoing guidance on the Evaluation of Corporate Compliance Programs (ECCP) and a new policy on incentivizing companies to adopt compensation and bonus plans tied to compliance and ethical behavior. From an ethics and compliance perspective, the most important changes are the department’s new three-year initiative, the pilot program regarding compensation incentives and clawbacks, and the changes to the ECCP guidance reflecting this new emphasis.

DOJ focuses on compensation and clawbacks in updated compliance guidance

The pilot program is the outgrowth of the DOJ policy announced in September 2022 that made personal responsibility for misconduct the department’s number one priority. As Deputy Attorney General Lisa Monaco stated in announcing the policy:

“Going forward, when prosecutors evaluate the strength of a company’s compliance program, they will consider whether its compensation systems reward compliance and impose financial sanctions on employees, executives, or directors whose direct or supervisory actions or omissions contributed to criminal conduct. They will evaluate what companies say and what they do, including whether, after learning of misconduct, a company actually claws back compensation or otherwise imposes financial penalties.”

The new three-year pilot program that implements the department’s policy has two main components. First, every corporate settlement of a DOJ misconduct investigation will include a requirement that the company develop and deploy compliance-promoting criteria within its compensation and bonus systems, including clawback provisions to recoup bonuses and compensation in the event the recipient participated in misconduct. Second, if and when a company uses its clawback procedures to penalize wrongdoers, the pilot program will provide fine reductions to those companies.

The changes to the ECCP note that a “hallmark of effective implementation of a compliance program is the establishment of incentives for compliance and disincentives for non-compliance” and advises prosecutors to “assess whether the company has clear consequence management procedures (procedures to identify, investigate, discipline and remediate violations of law, regulation, or policy) in place, enforces them consistently across the organization, and ensures that the procedures are commensurate with the violations.” It further states that prosecutors “should also assess the extent to which the company’s communications convey to its employees that unethical conduct will not be tolerated and will bring swift consequences, regardless of the position or title of the employee who engages in the conduct.”

Incentives and clawbacks tied to ethical conduct are growing in importance to E&C programs

Clawbacks are increasingly important in SEC enforcement as well. On October 26, 2022, the SEC issued a final rule that all securities exchanges must require issuers to recover amounts of incentive compensation from current and former executives that were based on erroneously reported financial information, regardless of whether the executive was at fault—a very broad approach. The DOJ’s recent March 3 announcement extends the focus on clawbacks to the criminal side of enforcement. The new pilot program seeks to incentivize organizations to implement such policies and use them to demonstrate a commitment to personal accountability if misconduct takes place.

And clawbacks are starting to be an important part of corporate misconduct settlements—more than 95% of DOJ’s misconduct investigations are settled rather than prosecuted. As part of the Danske Bank settlement in December 2022, Danske Bank agreed to revise its performance review and bonus systems to include compliance criteria. The Danske Bank plea agreement includes a provision that the bank will “implement evaluation criteria related to compliance in its executive review and bonus system so that each bank executive is evaluated on what the executive has done to ensure that the executive’s business or department is in compliance with the compliance programs and applicable laws and regulations” and a “failing score in compliance will make the executive ineligible for any bonus that year.”

LRN’s research over the years indicates that many companies are already using ethical behavior as a significant factor in compensation, bonuses, hiring, and promotion. Our 2023 Ethics & Compliance Program Effectiveness Report indicated that 89% of the top-rated E&C programs employed such criteria:

But just adding a few questions about ethics and compliance and asking supervisors to check the box on an employee’s ethical performance is unlikely to pass muster. Ethics and compliance behavior must rank on a par with other company functions in terms of how much weight it carried in performance review metrics and what performance criteria can be considered.

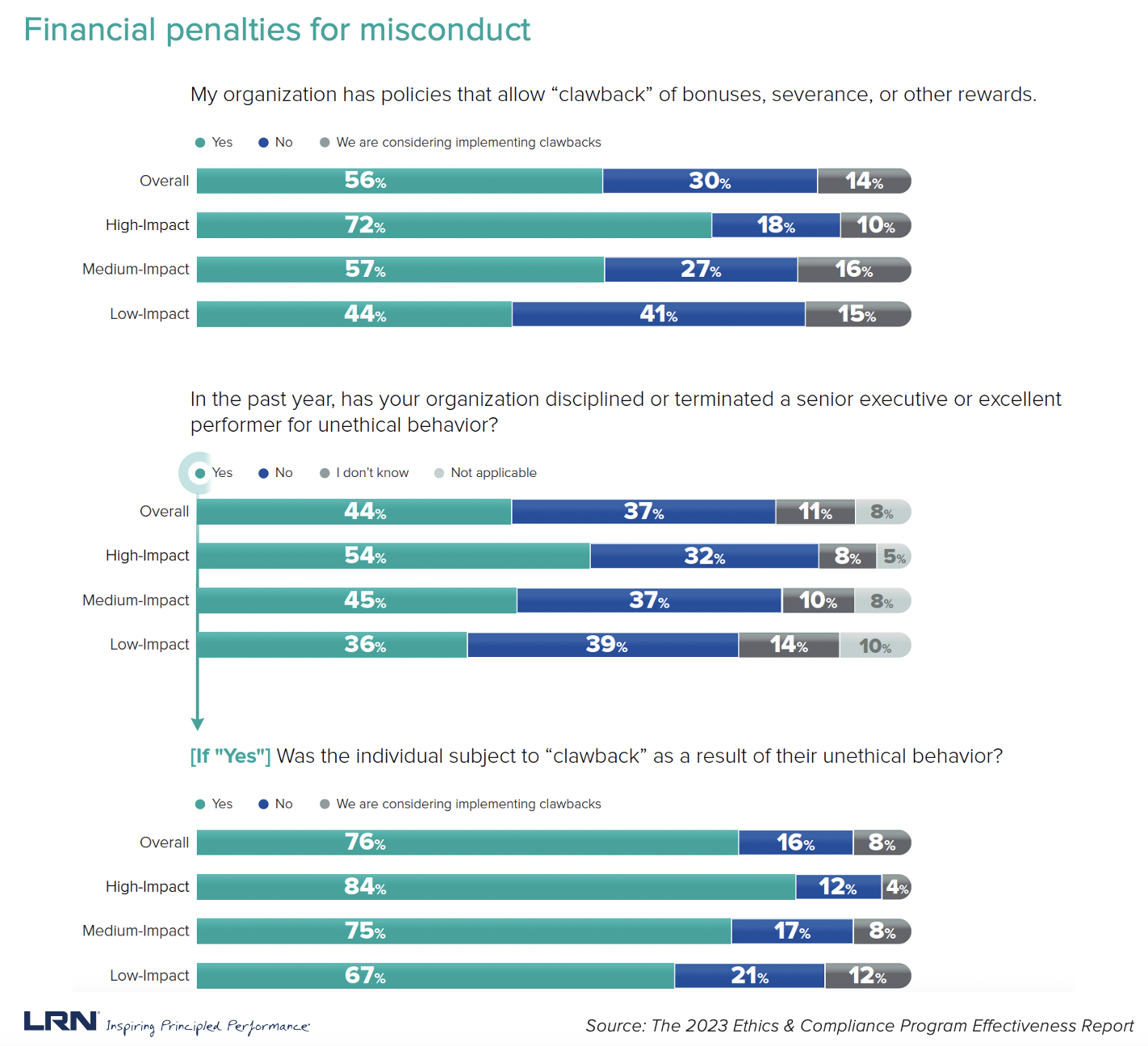

Our research shows that high-performing programs identified by LRN have clawback provisions and frequently use them, thus meeting the DOJ’s demand that they take action to penalize personal misconduct when it occurs:

It's important to work with Human Resources to ensure that not only performance reviews and incentives truly reflect the importance of an employee’s ethical behavior, but also the promotion process. Promoting high performers who flout the rules will attract negative attention from prosecutors if they engage in misconduct—no matter how good an E&C program looks on paper. And the DOJ policy announcements specifically say that financial penalties such as clawbacks should extend to supervisors and others who turn a blind eye to misconduct, even if they don’t directly participate in it.

Thus, implementing the new guidance should involve an in-depth and broad approach to an organization’s system of incentives and rewards to ensure that misconduct is discouraged and disincentivized.

3-second links

- The 2023 Ethics & Compliance Program Effectiveness Report

- March 2023 update from US Department of Justice Criminal Division – Evaluation of Corporate Compliance Programs

- Navigating the “perfect storm”: E&C program effectiveness in 2023

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers should consult with their own attorney regarding legal matters.